Kicking off with Taiwan in January, the wave of races will culminate with the US presidential election in November

Kieran McAuliffe

The Irish Examiner

4th December 2023

Election headlines look set to dominate the media in 2024. Next year will bring 40 national elections across the globe, representing more than 40% of the world’s population. Kicking off with Taiwan in January, the wave of races will culminate with the US presidential election in November.

The US presidential election is the most important known political event in 2024. Barring illness, accident, or legal proceedings, this will almost certainly be fought by incumbent Joe Biden and former president Donald Trump.

Concerns about Biden’s age and capacity persist although the same can often be said of Trump. The likely candidates will have a combined age of 159 years by the time the US electorate cast their votes next November. The election will be extremely divisive on social issues.

“For the global economy, a second Biden administration would provide continuity, a second Trump administration would be unpredictable with policy positions largely unarticulated and subject to change.”

A Trump administration would probably seek to reverse some of Biden’s reforms, lowering clean energy incentives and focusing less on environmental issues.

Regional tension in the Middle East and conflict in Ukraine will come into focus. Trump could scale back US support for Ukraine. A tough stance on China is welcomed by Republicans and Democrats — a Republican administration could ratchet this up further. The erosion of international norms and institutions seems likely to continue, especially under Trump.

Closer to home, the recent British cabinet reshuffle saw David Cameron reintroduced as foreign secretary after an absence of seven years from cabinet. This will give renewed optimism to the Conservative Party although a change to a Labour government is very likely to emerge in 2024.

“One of the most important elections in 2024 could be Taiwan. Not only does Taiwan hold a vital geostrategic position, but it is also a thriving hub for international trade.”

Campaigning in the election has focused on the major party’s differing views regarding Taiwan’s future vis-à-vis mainland China.

With every US election, there is some impact on the stock market as investors consider how the elected officials will affect economic policies.

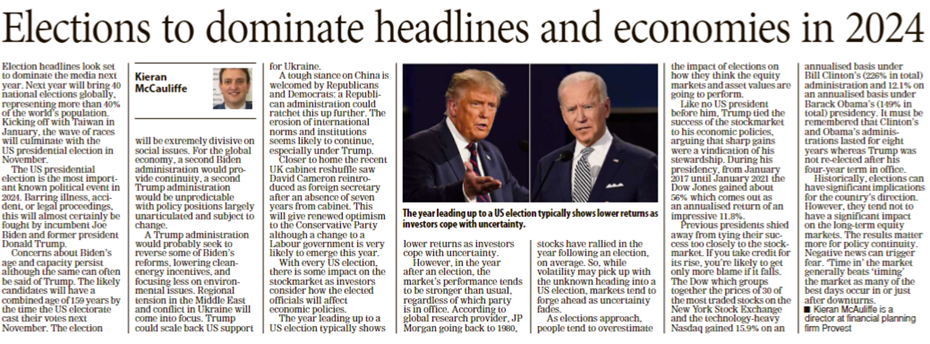

The year leading up to a US election typically shows lower returns as investors cope with uncertainty. However, in the 12 months after an election, the market’s performance tends to be stronger than usual, regardless of which party is in office.

According to global research provider JP Morgan, going back to 1980, stocks have rallied in the year following an election, on average. So, while volatility may pick up with the unknown heading into a US election, markets tend to forge ahead as uncertainty fades.

“As elections approach, people tend to overestimate the impact of elections on how they think the equity markets and asset values are going to perform.”

Like no US president before him, Trump tied the success of the stock market to his economic policies, arguing that sharp gains were a vindication of his stewardship. During his presidency, from January 2017 until January 2021, the Dow Jones Industrial Average (Dow) gained around 56% which comes out as an annualised return of an impressive 11.8%.

Previous presidents shied away from tying their success too closely to the stock market. If you take credit for its rise, you are likely to get only more blame if it falls.

The Dow which groups together the prices of 30 of the most traded stocks on the New York Stock Exchange and the technology-heavy Nasdaq gained 15.9% on an annualised basis under Bill Clinton’s (226% in total) administration and 12.1% on an annualised basis under Barack Obama’s (149% in total) presidency. It must be remembered that Clinton and Obama’s administrations lasted for eight years whereas Trump was not re-elected after his four-year term in office.

Historically, elections can have significant implications for the country’s direction. However, elections tend not to have a significant impact on the long-term equity markets. The results matter more for policy continuity. Negative news can trigger fear. “Time in” the market generally beats “timing” the market because many of the best days occur during or immediately following downturns.

Kieran McAuliffe is a director at financial planning firm Provest.